City or beach? With a two-centre holiday, you don't have to choose.

For many holidaymakers, deciding where to go can feel polarising. A recent study found that Brits’ most popular recent holidays were beach (34%) followed closely by city break (32%). Yet few of us take advantage of the opportunity to combine the two. After all, blending both experiences into one holiday might require thorough planning.

That’s where we come in. We’ve researched the best multi-centre holidays to offer the best of both worlds in one go – double the adventure, while still giving you plenty of time to unwind.

So, if you want to experience both on your next trip, read on: we've picked the top destinations with beach and city options, all within driving distance or a public transport ride.

We’ve also grouped these by affordability (excluding return flights) – so whatever your budget, we’ve got you covered.

Wherever you decide to take your next adventure, make sure you compare your travel insurance for the right cover for you and your travels.

Methodology

As part of the research process, we created a longlist of destinations offering both cities and beaches within a four-hour journey of one another, making them an easy option for visiting in the same trip. These locations were then ranked based on uniqueness and bucket-list appeal to create a refined shortlist. Finally, each destination was categorised by affordability (excluding return flights).

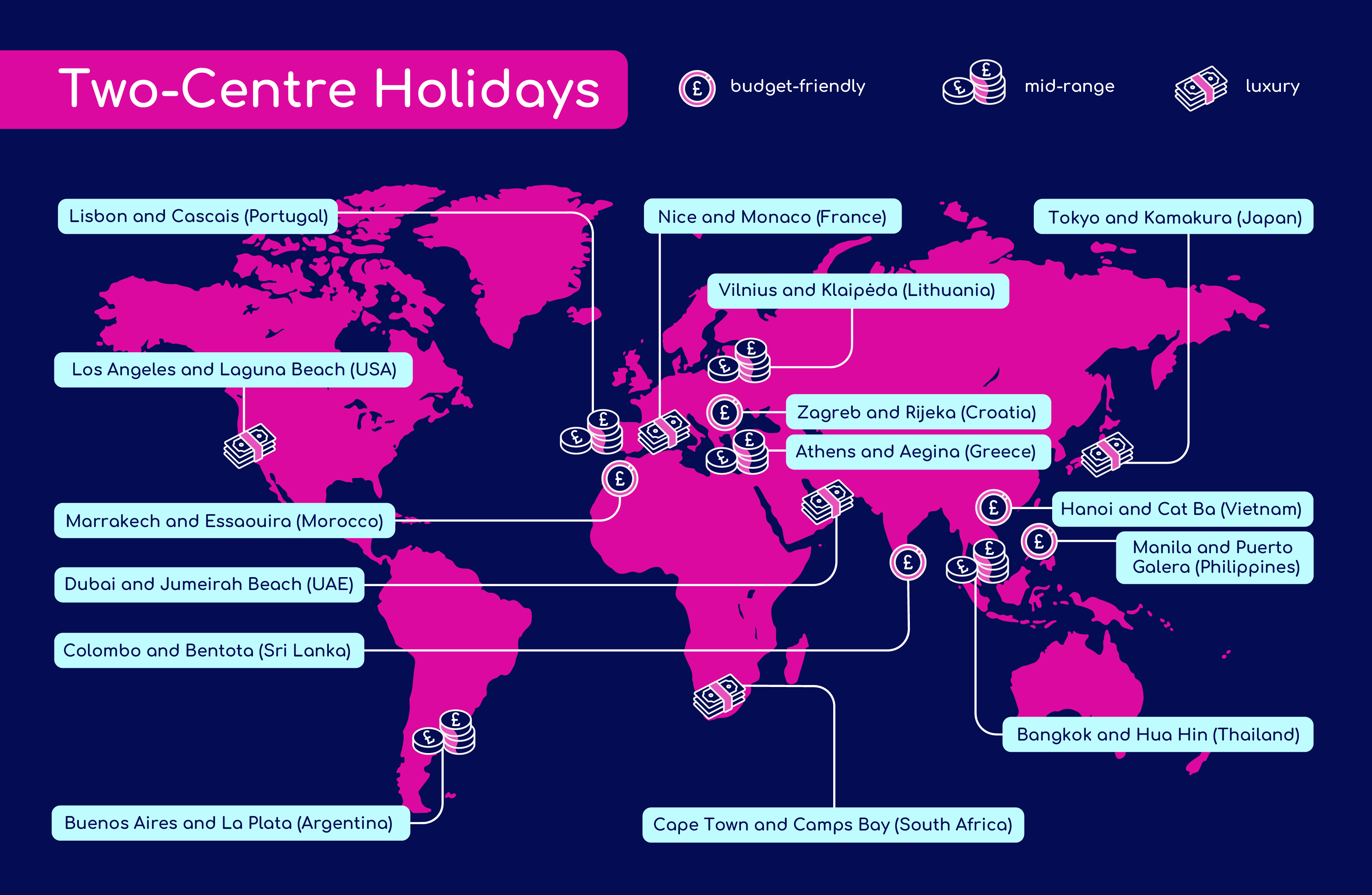

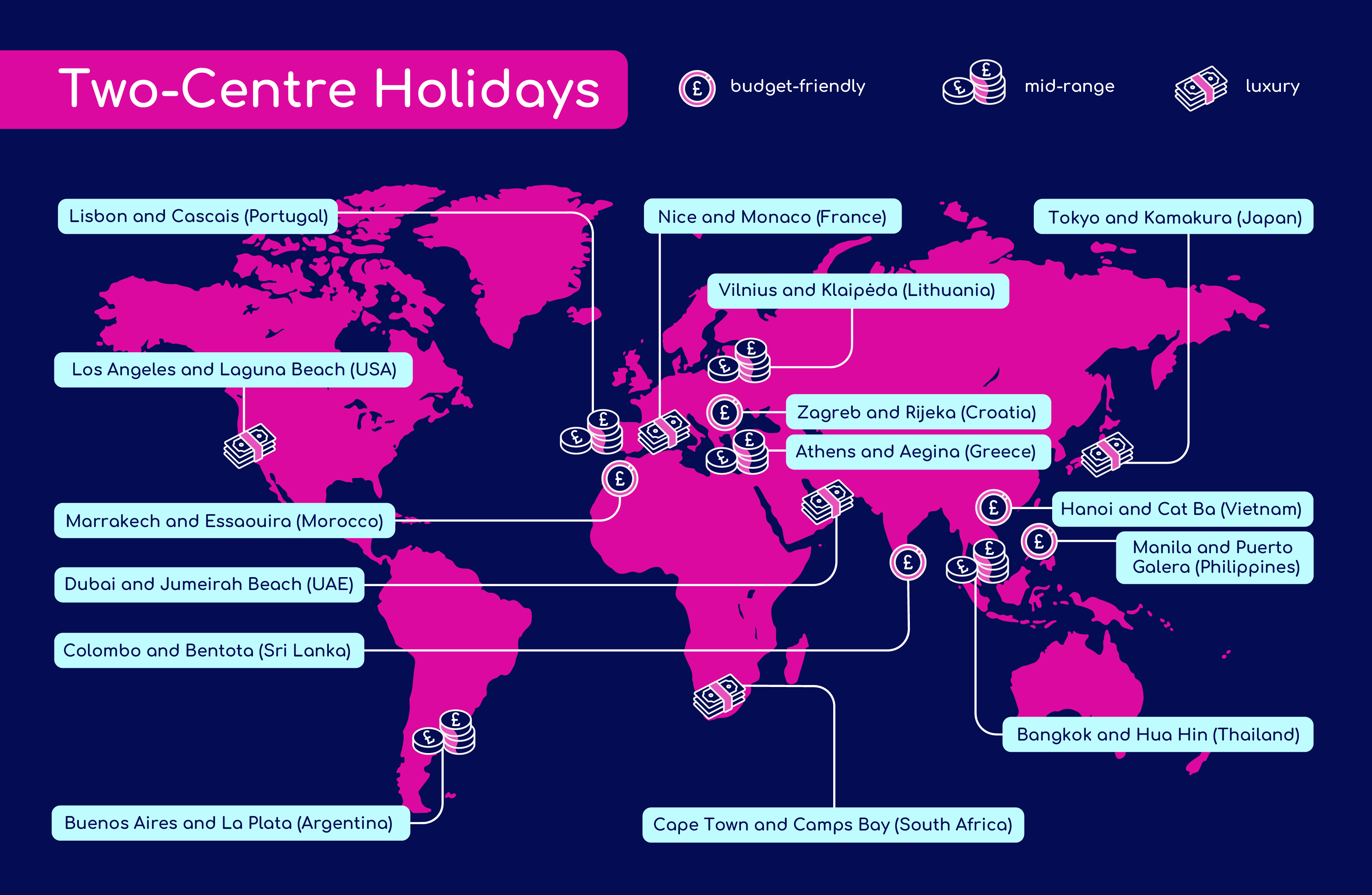

Our map below highlights all the top twin-centre destinations. The icons indicate which places are budget-friendly, mid-range and luxury, to help you find the best two-centre holiday for you!

What are multi-centre holidays?

A multi-centre holiday combines two or more destinations in a single trip. Why limit your holiday to just the bustling streets of a city when you can discover a sandy coastline, too?

A two-centre holiday, also known as a twin-centre holiday, means visiting just two destinations in one trip. It’s a great option for holiday-goers who have different preferences, but don’t want to spend too much time on the road.

Whether you prefer to lounge in the Caribbean or go island-hopping around the Maldives, a multi-centre trip is a great way to experience a variety of different activities.

What are the best two-centre holidays?

It’s no surprise that two-centre holidays are growing in popularity, considering that they’re double the fun. One minute you’re lying on a beach in Argentina’s Mar del Plata, and the next you’re exploring art galleries and museums in Buenos Aires. Or you're basking in the stunning beaches of Miami before driving to enjoy Disneyland rides in Orlando.

But what makes for the best twin-centre experience?

Ideally, you can combine beach and city breaks to offer the perfect balance for travellers seeking both relaxation and exploration. Recent research from YouGov shows that nearly half of Brits (47%) enjoy trips that combine sightseeing and relaxing.

Wherever you plan to travel, there's a perfect option to get a 'best of both’ holiday. Explore our favourite itineraries for every budget below.

Top budget-friendly twin-centre holidays

1. Hanoi and Cat Ba Island (Vietnam)

A ‘pho-nomenal' adventure with beachside bliss

City appeal: Hanoi is known for its captivating blend of chaotic charm with its ancient temples, French colonial architecture, iconic landmarks and lively street food scene. The Old Quarter is a maze filled with history and energy, with fine silks, jewellery and traditional puppet shows.

Beach appeal: Cat Ba Island offers a peaceful tropical escape, boasting breath-taking limestone cliffs, hidden beaches, and crystal-clear waters. Ideal for kayaking and canoeing, visiting Cat Ba can help bring out your inner adventurer.

Journey length: Approximately 2 and a half hours by bus or ferry.

2. Zagreb and Rijeka (Croatia)

Inland charm with coastal calm – Croatia's twin charmer

City appeal: Offering an unforgettable blend of historical charm with modern flair, Zagreb’s elegant streets, lively squares and vibrant artistic scene make it a perfect spot for those seeking to explore an underrated European city with a relaxed vibe.

Beach appeal: A historic port destination, Rijeka offers easy access to stunning Adriatic beaches, like Sablićevo, where crystal-clear waters and a peaceful atmosphere provide the perfect setting for relaxation, or Ploče and Kostanj beaches, which are great spots for water sports.

Journey length: Approximately 2 hours by car or train.

3. Manila and Puerto Galera (Philippines)

Filipino flair with urban pulse and an island escape

City appeal: History enthusiasts will know that Manila is famous for its vibrant blend of Spanish colonial history and Intramuros, the walled old town, which offers a fascinating glimpse into the past. Boasting a vibrant culture, bustling markets and diverse cuisine, it's the perfect city spot to kick off a multi-centre adventure.

Beach appeal: Puerto Galera boasts soft white sands, secluded coves, and excellent snorkelling and diving spots, making it a tropical paradise. The Verde Island Passage is a particular highlight, known as 'the centre of the world's marine biodiversity'.

Journey length: Approximately 4 hours by bus or ferry.

4. Colombo and Bentota (Sri Lanka)

City spice and island paradise – a far-flung multi-centre winner

City appeal: Take a flight to Colombo, Sri Lanka's capital city. It offers a blend of colonial-era architecture, a bustling market and a lively food scene, making it a great introduction to the island.

Beach appeal: Bentota’s golden beaches are just an hour and a half away from Colombo. Feel the calm waters of the Indian Ocean and take in the tall coconut palm trees; the perfect setting to relax and bask in the warm sun.

Journey length: Approximately 1.5 hours by car or train.

5. Marrakech and Essaouira (Morocco)

Souks to surf: the ultimate trip for treasures and relaxation

City appeal: Immerse yourself in the vibrant world of Marrakech, where bustling souks, lively market squares, and majestic palaces await. Rich in history and culture, this North African gem offers a sensory feast and serves as the perfect winter escape.

Beach appeal: Take a scenic drive to Essaouira, the ‘Jewel of the Atlantic’. Just three hours away from Marrakech, this charming location is known for its refreshing ocean breeze and pristine sandy beaches. It also boasts a picturesque medina and quaint fishing villages. It’s a must-visit destination that perfectly complements your Marrakech adventure.

Journey length: Approximately 3 hours by car or bus.

Best mid-range multi-destination holidays

6. Lisbon and Cascais (Portugal)

Pastéis and palaces: Portugal's perfect pair

City appeal: Enjoy the charm of Lisbon – with its pastel-hued buildings, iconic historic trams, and lively street scenes, it stands out as one of the most enchanting capitals.

Beach appeal: The coastal town of Cascais offers breath-taking Atlantic beaches, including the stunning Praia da Rainha. Known for its golden sands, dramatic cliffs, and crystal-clear waters, Cascais is the perfect seaside escape to complement your Lisbon adventure.

Journey length: Approximately 40 minutes by train or car.

7. Athens and Aegina (Greece)

Greece's golden getaway, with Acropolis views and Aegean blues

City appeal: Step into the heart of Western civilisation by exploring the ancient city of Athens. Home to iconic ruins like the Acropolis, Athens effortlessly combines rich history with vibrant nightlife, offering a unique experience that bridges the past and present.

Beach appeal: As a bonus, it’s only a short ferry ride away from Aegina, popular for picturesque beaches. With over 20 stunning beaches to choose from, Aegina’s Agia Marina stands out, where golden sands meet crystal-clear turquoise waters – ideal for unwinding and soaking up the Greek sun.

Journey length: Approximately 1 hour by ferry.

8. Buenos Aires and La Plata (Argentina)

Tango beats and seaside retreats – Argentina's dynamic duo

City appeal: Tango the night away in the vibrant streets of Buenos Aires and explore its grand boulevards and faded architecture. It’s a delightful mix of Europe and Latin America.

Beach appeal: Spend time by the pristine beaches of La Plata. With endless stretches of golden sand, Mer del Plata offers the perfect beach getaway. Take a stroll along the scenic promenade or catch the waves at Playa Varese, one of the top spots for surfing in Argentina. No matter your vibe, be assured that this town has a place for you.

Journey length: Approximately 1.5 hours by car or bus.

9. Bangkok and Hua Hin (Thailand)

Tuk-tuks to tranquillity in Southeast Asia’s twin titleholder

City appeal: Welcoming millions of tourists each year, the sultry and warm capital city of Bangkok is a vibrant fusion of history and modernity, where grand temples and vibrant floating markets are contrasted by sleek rooftop bars offering breathtaking city views. From the stunning Grand Palace to the lively street food stalls, this bustling metropolis is a sensory overload that never sleeps.

Beach appeal: For those interested in some well-deserved relaxation, you can find the royal seaside town of Hua Hin, just a two-hour train or car ride away from Sin City. It offers long stretches of sandy beaches, warm waters, and a laid-back atmosphere perfect for families, making it the destination for those seeking both serenity and adventure by the sea.

Journey length: Approximately 2 hours by car or train.

10. Vilnius and Klaipėda (Lithuania)

Multi-destination marvels, from Baltic baroque to the Amber Coast

City appeal: Explore the quintessential beauty of Eastern Europe by taking a trip to Vilnius, Lithuania. Famous for its quirky artistic side and relaxed café culture, the city’s bohemian Uzupis district and medieval town are a must-see tourist spot.

Beach appeal: Treat yourself to a peaceful and scenic retreat by visiting the Baltic seaside town of Klaipeda. Less than four hours from Vilnius, Klaipeda is a natural wonder, boasting white sandy beaches with a backdrop of pine forests and dunes.

Journey length: Approximately 4 hours by car or train.

Top high-end multi-centre holidays

11. Nice and Monaco (France)

Côte d'Azur chic with casino mystique: multi-centre with the Midas touch

City appeal: Start by experiencing the Mediterranean charm of Nice, home to the iconic Promenade des Anglais. This scenic 4-mile stretch, lined with palm trees, offers the perfect setting for a leisurely stroll, a bike ride, or even rollerblading as you take in stunning views of the coastline.

Beach appeal: For a luxurious beach experience, take a 40-minute car or train ride to reach Plage Mala in Monaco. Its crystal-clear blue waters and breath-taking view of the Saint-Jean Cap-Ferrat peninsula make it the ultimate lavish summer destination.

Journey length: Approximately 40 minutes by train or car.

12. Los Angeles and Laguna Beach (USA)

Star-studded Hollywood nights and relaxed, beachside delights

City appeal: Add a little glamour to your vacation by adding Los Angeles to your two-centre holiday itinerary. The entertainment capital of the world, which can be your main destination, offers tourists an interesting blend of Hollywood charm, diverse neighbourhoods, and an unbeatable food scene.

Beach appeal: Just a short 1.5-hour drive away is Laguna Beach. Popular for its golden sands, rugged cliffs, and an artist colony vibe, it provides visitors with a scenic and exclusive beach experience.

Journey length: Approximately 1.5 hours by car.

13. Tokyo and Kamakura (Japan)

From skyscraper sparkle to a tranquil marvel: Japan’s two-centre titan

City appeal: Japan’s capital city, Tokyo is a dazzling metropolis of ancient temples, neon-lit skyscrapers and an unparalleled food scene. A charming mix of traditional and modern, Tokyo has something for everyone.

Beach appeal: Once you’ve taken in the stunning sights in Tokyo, hop on a train and head on to Kamakura. Just an hour away from the city, its enchanting coastline is popular for its soft sands and gentle waves. Lucky tourists can even catch a glimpse of the mighty Mount Fuji on a clear day.

Journey length: Approximately 1 hour by train.

14. Cape Town and Camps Bay (South Africa)

South Africa's ultimate combo: Table Mountain views with Atlantic Ocean hues

City appeal: A city with a breath-taking view, Cape Town is centred around Table Mountain, which is recognised as one of the new 7 wonders of the world. Whether you want to experience the magnificent scenery or taste their delicious wine, Cape Town is an unforgettable holiday destination.

Beach appeal: As a bonus, in just 15 minutes, you can find yourself at Camps Bay Beach. Located on the foot of the majestic Twelve Apostles Mountain range, the white sands and turquoise waters are complemented by trendy restaurants and bars.

Journey length: Approximately 15 minutes by car.

15. Dubai and Jumeirah Beach (UAE)

Gold Souk opulence to coastal indulgence: a twin-centre for trendsetters

City appeal: Discover the futuristic allure of Dubai, where innovation seamlessly blends with unparalleled luxury. This vibrant city is a stunning fusion of towering skyscrapers, thrilling desert escapades, and world-class shopping experiences.

Beach appeal: Just 15 minutes away from Dubai is Jumeirah Beach, which offers a breathtaking escape with its soft, white sands, inviting Gulf waters, and lavish surroundings, all set against the iconic Burj Al Arab – a symbol of Dubai’s grandeur.

Journey length: Approximately 15 minutes by car or metro.

Our recommendations for accessibility, uniqueness and wow-factor twin destination holidays

Top pick for accessibility: Cape Town and Camps Bay (South Africa)

Cape Town is well-connected with plenty of public transport options – buses, taxis, and private services – and boasts wide, smooth pavements. Camps Bay is especially accessible, featuring wide promenades and flat paths leading to the beach. Nearby hotels and restaurants are disability-friendly, and the beach offers special facilities to make the sand and sea more accessible.

Top pick for off-the-beaten track: Vilnius and Klaipėda (Lithuania)

Vilnius’ best-kept secret is its thriving underground art scene. The Republic of Užupis is a quirky, self-declared 'independent republic' within Vilnius, known for its street art, galleries, and creative vibe.

Another hit for travellers who love lesser-known destinations, nearby Klaipėda is unmissable for its sand dunes and quiet beaches. A unique mix of culture and maritime heritage makes it a hidden gem.

Top pick for ticking off your bucket list: Tokyo and Kamakura (Japan)

Tokyo is a vibrant city brimming with experiences for everyone. Movie lovers can step into the magical Studio Ghibli Museum, while history buffs can take in the timeless beauty of ancient temples. It's a food lover’s dream too, offering everything from ramen to crispy takoyaki.

For a breath of fresh air and a dose of nature, nearby Kamakura is your perfect escape. Don’t miss the chance to hike the scenic Daibutsu Trail, which winds through the hills with panoramic views of Kamakura’s lush landscape and the vast Pacific Ocean stretching beyond.

Tip: compare travel insurance for the right cover, wherever you go

Planning a holiday is a collaborative experience. Research found family members increasingly discuss travel plans, highlighting the growing importance of trips that cater to everyone. But it doesn’t stop at curating your dream itinerary; protecting your finances and wellbeing is just as crucial when planning a getaway.

Safeguard your trip with travel insurance. Look for an option that provides protection against unexpected events that could disrupt your well-deserved vacation. If you have pre-existing medical conditions, it’s especially important to make sure you're fully covered for each one and they’re declared on your policy documents.

Take time to research and compare travel insurance options just as much as you research your trip. If possible, buy your cover the moment you book your holiday, so you’re covered for unexpected cancellations in the run up to the trip.

We know how confusing it can be to switch between different websites to compare options, so we’ve made it easy. Compare multiple products and prices in one place, without the need to re-input your details each time. It’s designed to help you find the cover that suits your needs.

Wherever you're planning your two-centre holiday, find out what visas and documentation you may need well in advance. It means that when you’re ready to set off, you can just relax and fully enjoy your trip.